- The only reason there exists Finance is because of Time and Risk just like the only reason the majority of Computer Science exists is due to Time and Space.

- All business practices boil down to two functions:

- Valuation of assets

- Management of assets [ Management is basically choosing the more Valuable option for a given Objective ]

So Objectives + Valuation => Decision

Financial Markets help us establish value through the “price discovery” mechanism

Valuation is generally independent of Objectives

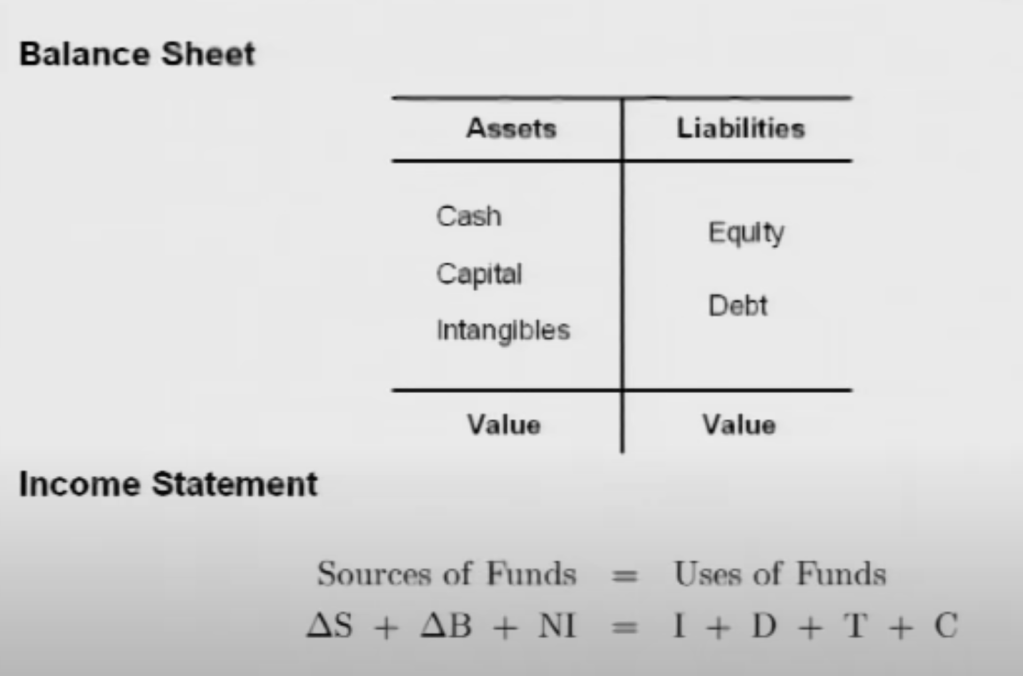

The Balance Sheet measures the Stock of Wealth of the Company – What your assets are and what your claims on those assets are [ liabilities ]

The Income Statement measures the Flow of Wealth into the company or out of the Company. This tells us how much the company is making per unit time or losing per unit time.

6 Fundamentals Principles of Finance:

- There is no such thing as a Free Lunch [ There might be occasional free lunches, but there are no free lunch programs ]. Systematic transfers of Wealth for no reason at all are highly Unlikely

- The Patent process creates Assets out of Ideas and it allows you to generate Economic value from that in exchange for freely sharing those ideas! But there are other Ideas that are Assets but are Trade Secrets like the recipe of Coca Cola!

- As Asset at a given point T is simply equal to a SEQUENCE of its future cash flows! As Asset is ALWAYS defined at a time T, and it is NOT equal to its past cash flows! its not a Summation, it is JUST a Sequence!